> Introduction

> "The fundamental five": Key trends that are defining the industry

Insights from pharma leaders and 4 key strategies to navigate the future

This quote from Art of War author Sun Tzu encapsulates the situation facing pharma companies in a volatile external environment in 2025 and 2026. The industry is weathering a ‘perfect storm’ of external trends, from political and economic instability to AI and other rapid technological advancements. There is risk, but there is also opportunity.

This report examines five key industry-level trends, identified through conversations with pharmaceutical leaders, which may define pharma company trajectories in the years ahead. Adapt to these trends and companies can remain resilient in a dynamic environment. Failure to adapt could lead to diminished market standing, regulatory delays, and reduced patient access.

We conducted 36 in-depth one-to-one interviews with leaders from 20 pharma companies across four key functions: Government Affairs, Medical Affairs, Market Access and Patient Affairs. The goal was to evaluate industry priorities and preparedness for current and emerging industry trends.

From this process, some clear strategic priorities and function-level critical success factors emerged to help guide pharmaceutical companies in future priorities.

Before we examine the pharmaceutical industry trends, let us briefly remind ourselves of the current wider macro environment, which is influencing and shaping the industry.

Political instability, driven by social inequality, discontent with traditional systems and declining trust in ‘elites’, is leading to more populist policy making with downstream impacts across all industries. We are seeing an ‘unprecedented rise in global military expenditure, which inevitably comes at the expense of other budget areas such as health.

Global financial markets are being hit by a decline in business and consumer confidence. Although the pharmaceutical industry has long been considered “recession proof”, it is expected to face significant financial headwinds.

While the world is more connected than ever through data and digital innovation, elements of society are becoming more insular, with trade barriers, supply chain disruptions and more which are contributing to an era of declining global connectedness. The rise of artificial intelligence (AI) marks a transformative development, yet brings with it many far-reaching economic, legal and regulatory considerations.

Meanwhile, global sustainability continues at pace, including a greater focus on net-zero targets and carbon reduction, and a shift towards circular economy principles like reuse and recycling.

So, what does this all mean for the pharmaceutical industry? In this fast-moving external environment, where do pharma companies focus? What are the trends above all others that will shape the industry in the years ahead?

In our discussions with leaders in the pharmaceutical industry, five key trends consistently emerge (see image below). These trends at the healthcare and pharmaceutical industry level are shaped by the macro environment and, in turn, should be key determinants of company-level strategy.

Many countries are witnessing a decline in healthcare expenditure relative to gross domestic product (GDP), often prioritizing defense and other sectors.i Global healthcare budgets are under ever increasing pressure, driven by ageing populations and the rise of non-communicable diseases (NCDs).

The high prices of modern pharma innovations have prompted broader discussion on the overall value of medications. Meanwhile, the pharma industry is facing spiraling costs associated with research and development, manufacturing, and the complexities of clinical trials. On the plus side, advancements in data analytics, digital technologies, and AI present significant opportunities for cost reductions throughout the pharmaceutical value chain.

The drug development ecosystem is undergoing fundamental transformation, including more decentralized and technology-driven approaches.

Demonstrating the value of modern innovative therapies can be challenging in traditional clinical trial models. For example, while there is great potential for targeted combination therapies in cancer, the pharmaceutical value chain – clinical trials, regulation, payer assessment, pricing – is very much designed for monotherapies.

Regulatory agencies and payers are increasingly supporting the use of innovative clinical trial designs – such as enrichment designs, adaptive designs and master protocols - to help support regulatory and reimbursement decision-making. Technology such as AI and machine learning is having a huge impact on clinical trials, helping to automate routine tasks, analyze enormous amounts of data, predict outcomes and improve data accuracy.

Broadly speaking, patients today are more empowered in their own health than in previous years, with a shift away from the traditional, paternalistic model of healthcare. However, the extent of patient empowerment varies hugely among different countries and demographics.

The use of AI could be game-changing, making it easier for patients and patient organizations to collect data and use it to improve their own decision-making.

In terms of patient involvement in the broader healthcare system design and implementation, the overall trend appears positive. Patient involvement has been a fundamental element of regulatory and HTA activities for several years in many countries and patient capabilities are increasing.

However, patient involvement is still mostly in the form of consultation rather than genuine decision-making. For patients to have a real say in decision-making, a more evidence-based approach is needed to demonstrate the value of patient involvement. Better reporting and measurement tools are required, with a shift towards evidence-based engagements with patients and patient advocacy groups (PAGs). At the same time, PAGs must continue to develop their capabilities to enable meaningful interactions with decision-makers.

Health equity – defined by the World Health Organization as “the absence of avoidable or remediable differences in health among population groups” – is in the interest of us all. However, while all health stakeholders agree that health equity is an essential goal, health equity remains an aspiration.

If anything, the health divide is growing, with widening gaps in health outcomes between richer and poorer populations.vii At the same time, a huge shift in the dynamic of the global population is occurring. By 2050, about 80% of adults aged 60 and above are projected to reside in LMICs requiring substantial shifts in infrastructure, policies, and services to support their needs.

Health equity should be viewed as a social responsibility for the pharma industry. It may not be too extreme to say the industry’s social license to operate is under threat. Public perception of the industry is low on trust, seeing high drug prices and a focus on financial performance over patient needs. A focus on health equity is also a strategically beneficial business imperative that can lead to improved patient outcomes, expanded market access, and long-term commercial sustainability.

Disruptive technology – in particular AI – is a trend that offers some potentially groundbreaking solutions for all the other four trends. AI / digital innovations are revolutionizing every aspect of pharma operations, from R&D acceleration and care delivery to treatment pathway design and patient engagement strategies. Ultimately it is hoped that this will lead to faster drug discovery and development, reduced costs, and improved patient outcomes.

While the potential benefits are huge, pharma companies must learn to scale the use of AI and address the industry’s unique challenges – such as the complexity of the industry’s data and the uniqueness of its regulations and technology. Such a seismic shift may require companies to rethink their traditional operating models and structures, which will not be easy.

Attracting the best minds in AI will be essential – as will having the bravery to implement their recommendations. We are relatively near the beginning of this journey, and companies need to learn how to fully utilize and channel the power of AI.

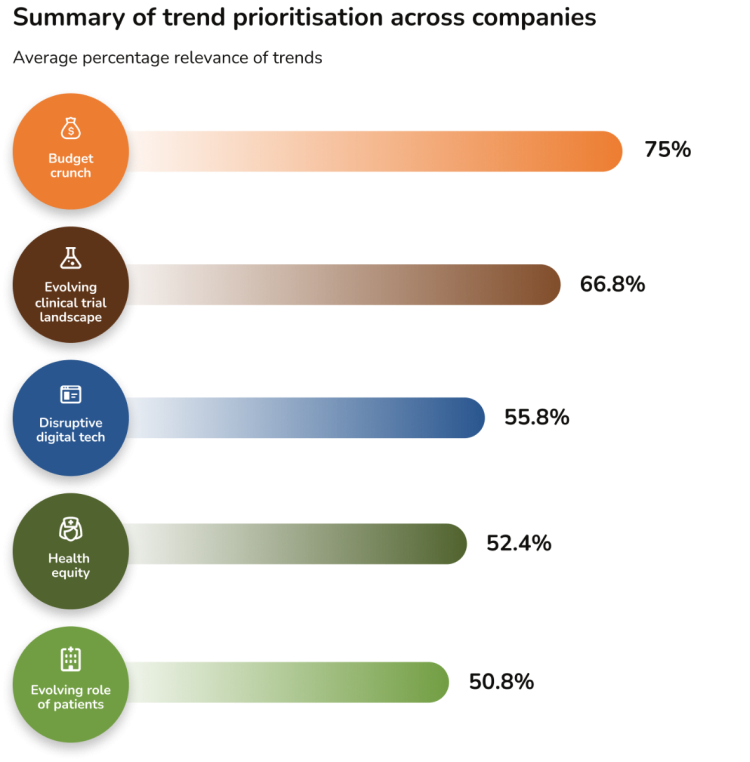

Interviewees were asked to rank the relevance of the five healthcare trends to their function and company. The below image shows the overall results on the relevance of the trends as a percentage of all answers.

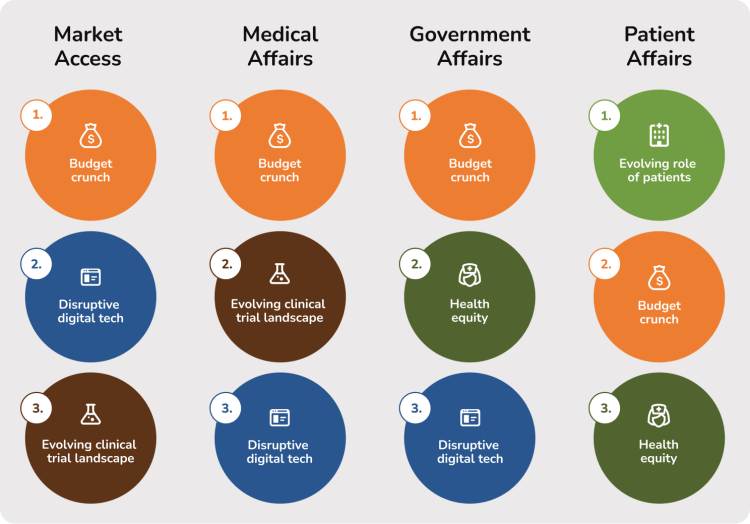

Interviewees were asked to rank the relevance of each of the five healthcare trends to their function. Illustrated below are the top three trends by function:

It is understandable that addressing the ‘budget crunch’ is considered the highest priority. Companies are trying to secure broad access for modern innovations in an environment of increasing financial restriction and scrutiny. Companies must present compelling value propositions that demonstrate significant clinical, economic, and societal advantages over current standards of care to a range of stakeholders, including payers, patients, investors, and regulators. Notably, the ‘evolving clinical trial landscape’ ranks as the second highest priority, reflecting the need for robust evidence that addresses specific clinical and economic requirements.

In contrast, while health equity and the evolving role of patients are important, they are often viewed as broader, aspirational objectives across most functions. The relatively lower emphasis on ‘disruptive digital technology’ suggests ongoing uncertainty regarding its optimal application, despite the transformative potential of digital solutions and AI.

Interviewees were asked to rate their “readiness for the future” for a range of capabilities associated with each of these trends (see Appendix for more details). Participants scored their level of readiness for each capability from 1 (not ready at all) to 4 (completely ready). The average readiness scores, per function, per trend, are below.

While it is important to recognize that capabilities differ by function, the variation in readiness scores among functions is notable. For instance, the scores suggest that Medical Affairs and Government Affairs are well prepared to address the Health Equity trend, whereas Market Access and Patient Affairs are less so. Government Affairs is the ‘most prepared’ to address the budget crunch issue, which aligns well with its remit and focus in dealing with health policy stakeholders.

Conversely, some of the lowest readiness scores are observed on the topic of disruptive digital technology, with both Market Access and Government Affairs stakeholders expressing relatively low readiness. In contrast, Medical Affairs, which has made substantial progress incorporating disruptive digital solutions into routine practice, reports higher readiness in this domain.

So, how can pharma companies navigate through an environment shaped by the trends outlined in this report?

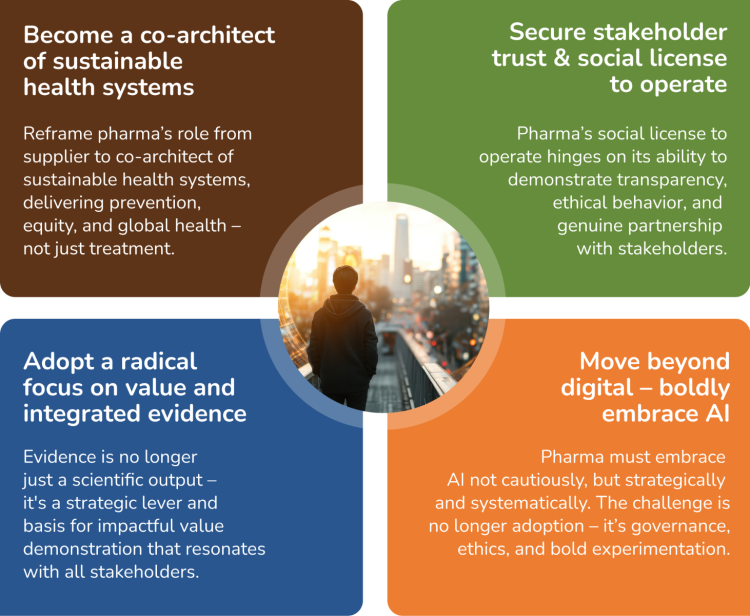

Based on insights from industry leaders, research and analysis of emerging healthcare trends, we have identified 4 key strategic priorities (below) to enable companies to be Ready 4 the Future. We believe these 4 key strategies can shape the future direction of companies while simultaneously supporting health system growth and sustainability.

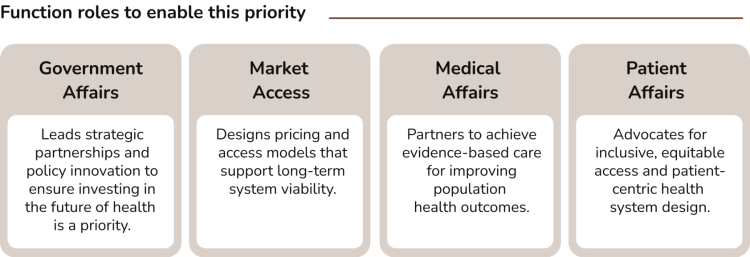

Rationale: Pharma’s future relevance will be measured not just by innovation, but by its contribution to health system sustainability. This means stepping up as a partner in solving systemic challenges like e.g. affordability, access equity, and workforce strain. Pharma needs to reframe its role from a supplier to a co-architect of sustainable health systems. This can be achieved by actively shaping policy, enabling equity, and building resilience through cross-sector collaboration to improve healthcare systems that deliver for better prevention, equity, and global health — not just treatment.

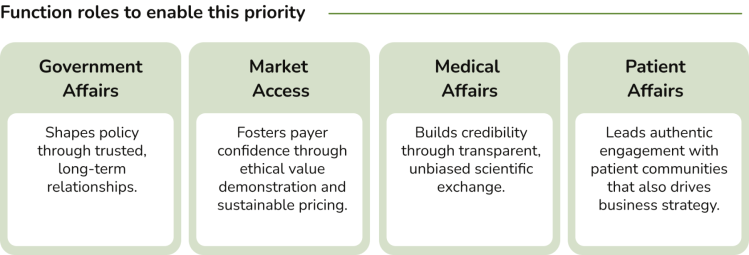

Rationale: In an era of rising scrutiny and shifting societal expectations, trust is no longer a soft metric — it’s a strategic imperative. Pharma’s social license to operate hinges on its ability to demonstrate transparency, ethical behavior, and genuine partnership with stakeholders. This means moving beyond transactional engagement to co-create value with patients, payers, policymakers, and healthcare professionals — including shared governance of data and outcomes.

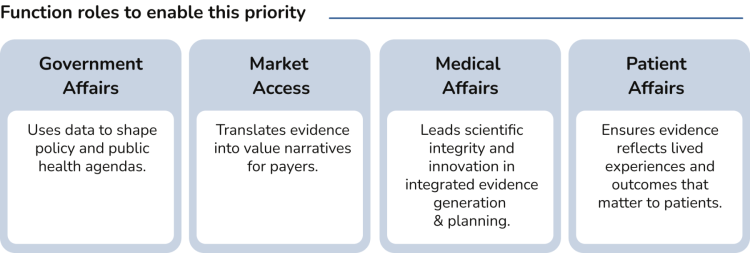

Rationale: Evidence is no longer just a scientific output; it's a strategic lever. Pharma needs to move beyond traditional data silos to create dynamic evidence ecosystems that are the basis for impactful value demonstrations to shape access decisions, policy frameworks, and public trust. The challenge is not generating more data, but generating meaningful, actionable, and persuasive evidence that resonates across stakeholders — from regulators to patients.

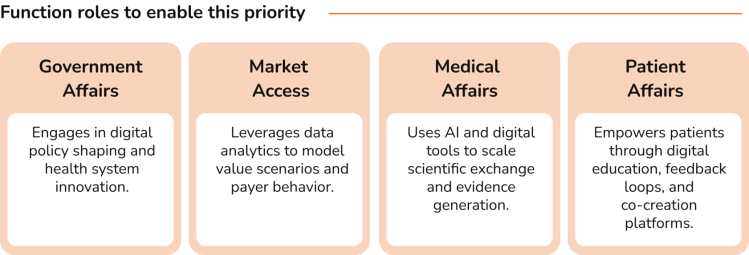

Rationale: AI is not just another tool in pharma’s digital toolbox; it’s the new operating system. The future-ready pharma organization won’t just use AI to optimize workflows; it will delegate decisions, predict stakeholder needs, and design interventions in real time. This is a shift from digital enablement to intelligent orchestration. Pharma must embrace AI not cautiously, but strategically and systemically – embedding it across evidence generation, stakeholder engagement, policy shaping, and patient support. The challenge is no longer adoption, it’s governance, ethics, and bold experimentation.

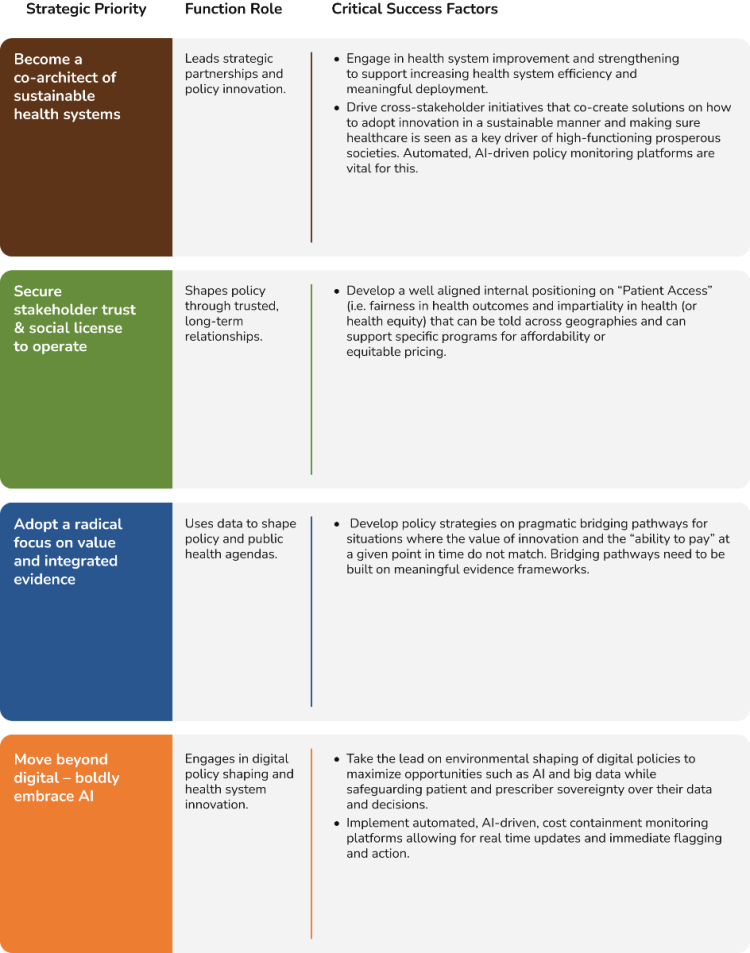

The rationale for the 4 strategies is clear, but how can they be implemented? In this section, we outline the critical success factors for each function to make these 4 priorities a reality. We do not believe these will be seismic shifts for most companies. Many of these will likely be aligned with what functions / companies are already doing, or know they need to do – it is about prioritizing and accelerating these critical success factors in the near future.

In today's environment, where in many markets, companies are required to demonstrate product value on a given set of metrics to justify health system expenditures, Government Affairs plays a critical role in advancing health system growth and sustainability. This function closely collaborates with governments and other policy makers to facilitate access to medicines while effectively managing costs.

Government Affairs interviewees indicated that their functions are generally well-positioned to implement evidence-based policy making through collaboration with governments, academic institutions, and think tanks, and report strong alignment with internal stakeholders regarding proposed strategies. This alignment enables effective leadership in developing strategic partnerships and driving policy innovation.

Identified gaps include the need for Government Affairs to play a more instrumental role in promoting health equity. Currently, there is neither a consistent definition nor a clear narrative around global health equity within organizations and what it means for Patient Access in a broader sense, and no unified strategy has been established.

Additionally, while Government Affairs teams demonstrate a clear understanding of corporate digital strategies, they have yet to fully leverage digital tools such as AI-powered monitoring platforms for cost containment, to support the development of evidence-based, data-driven policies. Interviewees acknowledged opportunities for improvement, noting that best practices from other functions could inform more effective use of digital solutions to enhance health system efficiency.

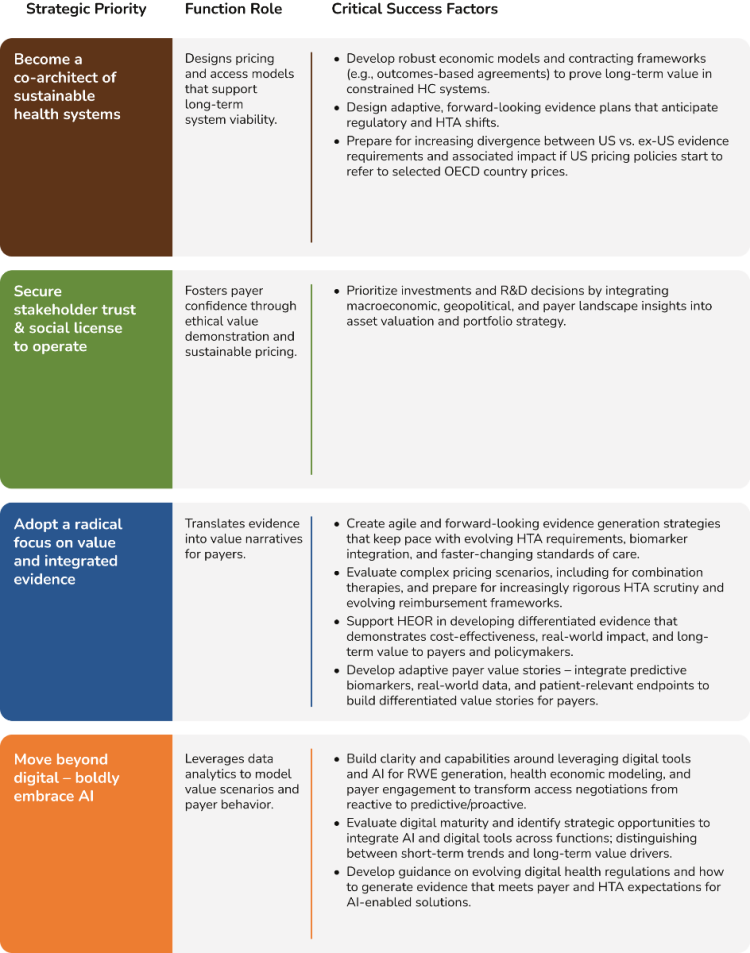

In an environment of budget constraints due to economic slowdowns, increasing healthcare costs to manage ageing populations, and shifts in national budgets away from health (e.g. to defense spending), Market Access teams have the task of finding access solutions for increasingly novel premium-priced medicines.

Current discussions in the US around tying public and commercial pricing to jurisdictions outside of the US challenge the established status-quo for Pharma and increase the strategic weight on prices achieved outside of US.

Among the Market Access contacts we spoke to, there appears to be a positive shift towards framing value in the long-term with a focus on innovative contracting solutions. However, implementation is uneven, often hindered by budget silos and limited openness among some payers for new approaches.

This needs to shift as the market is evolving with more complex therapies (e.g. combinations), which further strain pricing and reimbursement frameworks.

There also appears to be significant uncertainty around the best way to utilize AI in the sector, and implementation is currently relatively low. Regulatory concerns remain a major obstacle to uptake, and the feeling is that AI / digital technologies are evolving faster than regulatory frameworks and payer adoption.

In terms of evidence generation, interviewees said they are integrating their market access plans early in the drug development program enabling clinical plans, pricing strategies, and evidence generation to become more connected, and focused on demonstrating value.

However, there is room for further improvement, for example by ensuring that health outcomes / utilities such as healthcare resource utilization (HCRU) are measured in clinical trials, allowing for the development of pharmaco-economic models.

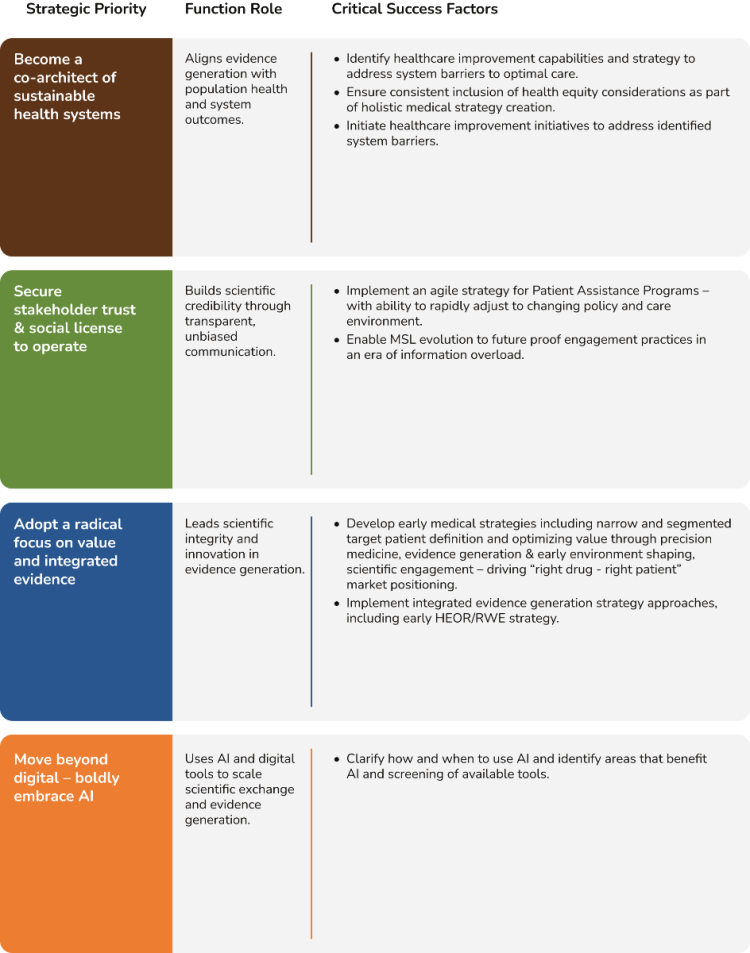

With under pressure healthcare systems seeking value for money, Medical Affairs teams are striving to demonstrate true differentiation of therapies over standards of care and to facilitate healthcare system efficiency through optimal capacity and resource utilization.

Interviewees noted that Medical Affairs organizations are adopting a more long-term perspective, which is having a positive impact on how the team interacts with stakeholders.

Companies are navigating how to apply AI to clinical trials to demonstrate value to multiple stakeholders, enable meaningful collection of real-world evidence (RWE), and ensure patient centricity when designing clinical studies.

In terms of challenges, implementation of AI and digital solutions can be hindered when certain therapeutic areas lack digital opinion leaders. And despite strong strategic positioning, improving digital literacy within Medical Affairs teams remains a top priority.

Some interviewees felt that cross-functional collaboration could be improved, and systems are still lacking, hindering internal knowledge sharing and collaboration. There are also some capability gaps when it comes to field teams engaging with HCPs on novel treatment modalities or complex trial designs, with respondents suggesting that HCP communications could be better tailored.

Patient Affairs teams are managing a degree of pressure both externally and internally – on one hand managing rising patient expectations and demands and a greater focus on patient-centricity, and on the other, needing to justify their strategic value internally across the full lifecycle. Internal pressure is increasing in part because of the challenge of demonstrating meaningful impact.

Although patient strategies are in place and linked to business objectives, it appears that patient engagement in many companies still occurs sporadically at specific times in the lifecycle.

Interviewees revealed that while patient engagement capabilities are generally strong at the global level, there are gaps at the affiliate level, which is unsurprising given the ‘generalist’ role that many staff at affiliate offices must assume.

In addition, patient interactions are still somewhat transactional, with a short-term focus on pharma needs as opposed to building long-term relationships regardless of current need.

Interviewees agreed that evidence generation is vital, and good progress has been made in terms of patients contributing to patient-centric clinical trial design. However, there is room to improve PAG capabilities around designing, collecting and submitting robust patient-centric data for policy, regulatory or HTA decision-making.

There is also a clear need for earlier and better patient engagement specifically around new modalities such as gene therapies to understand the very specific implications that these may have for patients and even co-create solutions together.

In a period of unprecedented change and uncertainty, companies need a clear and bold focus to navigate their way through. In this report, we set out four key strategies that we believe will enable pharma companies not only to endure, but to flourish.

All four priorities are purposely bold. This isn’t the time for half measures. In a period when the environment is changing significantly at pace and health systems are working with tighter resources than ever, being brave, decisive and bold can help companies to harness and maximize new opportunities as early as possible and give them a competitive advantage. Having courage and certainty also helps with inspiring motivation and confidence in the company and provides a clear vision for all to follow.

Companies who embrace these strategic priorities – those who are genuine co-architects of sustainable health systems, those who boldly embrace AI and so on – will gain a head start and in doing so, are also more likely to gain vital strategic partnerships early on, which will help to enable success. Yes, there may be some missteps along the way, but taking calculated risks has never been more important – or more potentially beneficial.

We have outlined key actions at the function level to make these strategic priorities a reality. Many of these critical success factors will already be familiar to the functions. Now is the time to identify the ones where amplification and acceleration are required to make them a reality. Cross-functional alignment will also be vital, ensuring everyone is united behind a clear set of overall objectives.

In the midst of chaos, there is indeed opportunity. If we embrace this opportunity, we can ensure we are ready – now, and for the future.