Access to personalized medicine: building a multi-stakeholder roadmap

A multidisciplinary workshop – titled ‘Access to personalized medicine: building a multi-stakeholder roadmap’ – took place on 11th November 2014 in Amsterdam. The workshop, organized by specialist healthcare consultancy Executive Insight, brought together representatives of several different stakeholders categories from a range of different countries and backgrounds, to discuss the subject of personalized medicine and specifically the opportunities and challenges it presents to each of them. All views presented were personal and not necessarily those of the represented institutions.

In this document we will outline the key conclusions from each stakeholder category, and demonstrate how these can feed into an overall ‘roadmap’ for success.

Background / rationale

Since the mapping of the human genome was completed in 2003, personalized medicine has been the subject of considerable attention and hype, with a vision of therapies that are much more closely tailored to individual patients. The personalized medicine market is already considerable ($232 billion in the US alone), and is projected to grow by 11 or 12 percent every year. While it is creating a booming market, it is undoubtedly a ‘disruptive innovation’ that healthcare stakeholders are still adjusting to, and which will create both opportunities and challenges alike.

That we are still in the infancy of this new era is borne out by the fact that no universally accepted definition of personalized medicine exists (instead, many different definitions exist). It can perhaps best be explained as a medical approach which is tailored to the patient or a group of patients – for prevention, prediction and treatment, moving away from the common "one size fits all" medical model. The goal is to provide the right treatment in the right dose to the right patient at the right time.

Workshop objectives

The objectives of the workshop were to:

- Share experiences and views on the opportunities and challenges of Market Access to Personalized Medicine

- Build a joint roadmap highlighting what needs to happen to ensure efficient patient access to Personalized Medicine in the future

- Get to know thought leaders from the same field and explore opportunities for future collaborations

Speakers – The Seven Perspectives

Seven high-profile speakers were invited to the workshop to present on the subject from their specific stakeholder perspective.

The HTA Perspective

A clear, agreed definition of personalized medicine is required

- There are currently multiple definitions of personalized medicine

- The term “personalized medicine” is actually a misnomer as it would be impossible to demonstrate benefit with medicine that is genuinely individual / personalized – “stratified medicine” may be a more accurate term

Better reimbursement frameworks for companion diagnostics are required

- Reimbursement assessment for diagnostic tests is often completely different to assessment for pharmaceuticals – In Germany for example, diagnostic / test assessment relies heavily on expert opinion and is therefore “eminence-based rather than evidence-based”

– Pricing decisions are made without any involvement from the industry - Personalized medicine (consisting of the diagnostic and the drug) may require a joint procedure, similar to the level required for pharmaceuticals (but with divided price decisions)

We need to define the ‘value’ of companion diagnostics

- Healthcare systems do not always recognise health-related benefit specifically associated with the companion diagnostic (but rather only with the subsequent therapy)

- The Grading of Recommendations Assessment, Development and Evaluation (GRADE) states that the best way to assess companion diagnostics is through randomly controlled trials – but these can be complicated and expensive

- High degree of evidence required by authorities (randomized controlled trial evidence)

– Complex study designs (studies will be more complex, time-consuming and expensive)

– New evaluation and study evidence requirements for existing lab tests

– No guaranteed international standard for minimum requirements regarding personalized

medicine

The Health Economics Perspective

The target patient populations are significantly smaller

- The target populations with personalized medicine are smaller - and therefore the price of drugs is more expensive

- An increasing number of drugs seeking orphan status

- This will lead to a switch from blockbusters to ‘niche-busters’

The onus is on industry to better demonstrate the value of personalized medicine

- The cost of targeted therapies overwhelms that of tests - so the cost of tests is not so relevant from a payer’s point of view

- Payers need to be mindful that industry may try and justify higher prices for their personalized medicines due to the smaller population sizes

- The evidence for some personalized medicine is lacking – and sometimes reimbursement is based on company assessment rather than an HTA’s own assessment

The Medical Perspective

Great medical progress has been made in personalized medicine – with oncology leading the way

- In oncology, personalized medicine has already had a significant impact

- Oncology has shown that personalized medicine functions most effectively through systematic multidisciplinary cooperation (e.g. via the oncologist / pathologist who provides diagnosis via sampling / the tumour board who can make an informed decision if targeted therapy is suitable)

Next generation sequencing represents the next significant advance

Next generation sequencing allows for the simultaneous sequencing of hundreds of millions of DNA molecules - but it is expensive

Better reimbursement for the diagnostic side of personalized medicine is required

- There is not sufficient Not all reimbursement for testing in current systems

- In Germany for example, the costs are included in DRG system which means the budgets of clinicians are exceeded

The Policy Maker Perspective

Education on personalized medicine is needed for policy makers

- Personalized medicine (consisting of the diagnostic and the drug) may require a joint procedure, similar to the level required for pharmaceuticals (but with divided price decisions)

- Although most policy makers understand that personalized medicine is going to change medicine and healthcare systems, only a few understand the details and the administrative barriers

- Personalized medicine will be a priority in Horizon 2020. However, on a national level, there is less clarity on the level of investment

Policy makers are concerned about certain challenges and risks associated with personalized medicine

- They are uncertain of the speed of change – is it an evolution or a revolution? It is very difficult to prepare / reform for the latter

- There are potential ethical and societal risks, such as who will have access to and own the genetic data? How will governments control masses of data?

- There are concerns on the potential impact on health insurance and patients’ employability

- Policy makers are concerned about the budgets involved

- In some countries, there are issues of inequity of access to personalized medicine treatments

Policy makers need support from other stakeholders to help put personalized medicine higher on government agendas

- A better understanding of the situation through education and dialogue

- Answers on ethical issues – assurance that there are clear safeguards on access etc.

- Reassurance on cost – via models of smart budgeting schemes

- Models of healthcare systems fit for personalized medicine e.g. what kind of upfront investment it represents and what consequences it will bring

- A clear definition of roles – who does what exactly and who is accountable at the international and national level

The Pharma Industry Perspective

Progress has been slower than expected

- From an industry perspective, there have been some elements limiting progress in personalized medicine, e.g.: – The science is more complex than expected; e.g. limitation on genetic prediction and patients’ response to therapies – Economic (regulatory & reimbursement) incentives are not aligned to support the development of clinical-utility data from decision making

- Despite this, the promise in personalized medicine remains very high for the industry

Reimbursement frameworks need to change – and industry incentives need to improve

- Changes need to be made in terms of reimbursement frameworks (which have changed very little in recent years); they need to adapt, to move towards better industry incentives and to allowing industry to realistically / economically develop enough data for decision makers to make a robust decision

- The incentives for evidence generation and rewarding the added value from innovative technologies outside the Rx framework are unclear

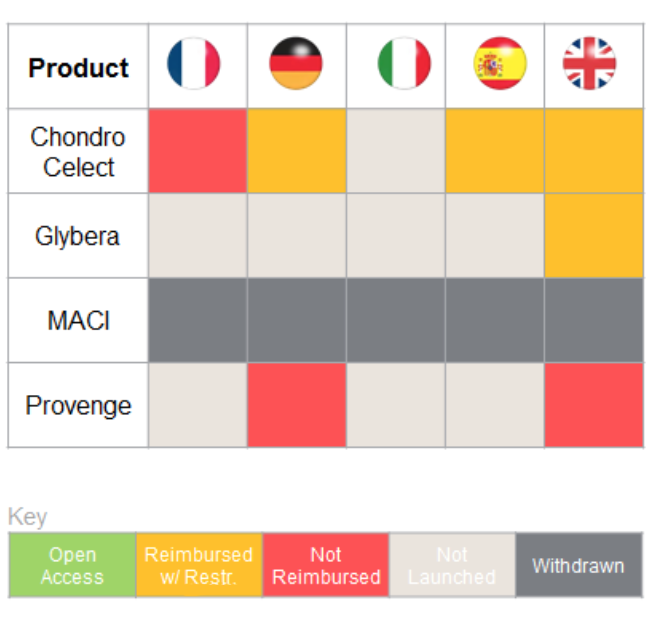

Innovative therapies – such as

ATMPs (Advanced therapy medicinal products) – could hold great promise for patients, but in the EU only four have been approved since 2007. All four have faced significant reimbursement / access challenges

- Current systems will undervalue ATMPs, reducing incentives to develop and market them

- Revisiting the value assessment frameworks would allow for the realisation of ATMP’s full potential

- Need a framework which rewards new therapies and reassures payers

- – Payers are not always comfortable with long- term benefits (e.g. promises that costs will be offset in the long-term) – too many variables / too few guarantees

– Funding systems work in siloes – one thing that works for one budget holder will not work for another

We need to demonstrate the ‘value’ of the companion diagnostic

- It is important to be able to demonstrate the value that the diagnostic brings as well as the drug

- This may need to be done through other methods than randomized clinical trials - decision- makers are willing to consider studies other than RCTs if well designed Clinical utility as an alternative to RCTs may have the potential to realise the value-generation from personalized medicines

- However, the industry is currently less interested in demonstrating the value of the diagnostic – they are happy to use the diagnostic as a loss-leader for selling the drug

It is important to recognize best practice where it exists

- The NICE Diagnostics Assessment Programme (DAP) focuses on the evaluation of innovative medical diagnostic technologies in order to ensure that the NHS is able to adopt clinically and cost effective technologies rapidly and consistently (42 technologies assessed to date, of which about 60% have been recommended)

- It represents a step forward in the assessment and guidance on technologies, with a potentially significant impact for personalized medicine

The Diagnostics Perspective

We need to define the ‘value’ of companion diagnostics and personalized medicine

The value proposition is a key consideration – what is the value your personalized medicine brings to the table? What does the diagnostic bring to the table?

Not all reimbursement systems are currently ready to assess companion diagnostics and treatments together

- Broadly speaking, countries fall into one of three categories – a separate assessment such as in Germany, a more coordinated assessment like France, or an entirely joint assessment such as that in the UK

- Ideally we need a global model of best practice that can be implemented locally

- Each country needs to identify which value proposition will appeal to them

Industry often happy to pay for the diagnostic

- The identification of a value proposition in terms of diagnostics is relatively new

- From a pharmaceutical company point of view, the diagnostics are not hugely expensive. Usually a one-time only cost and something companies can pay for themselves if needs be

The Payer Perspective

The economic climate is having a significant influence

Health expenditure is unlikely to keep increasing as a percentage of GDP – payers need to either get creative on how to spend money or decommission what they have been spending it on. We are seeing both

Payers need more certainty to reimburse – this can be provided through clinical evidence

- Payers assess the level of uncertainty associated with personalized medicine – and reimburse accordingly

- In situations where diagnostics (such as Coagucheck and InRatio) appear to be similarly effective, the guidance (in this instance from NICE) steers payers towards the one with the greater weight of clinical evidence

There can be a natural ‘handover’ in reimbursement from the pharma company to national payers

Successful examples in the past (e.g. HER2 testing) have started with the pharmaceutical company paying for the test until it becomes a national standard - at which point it is reimbursed by national health systems

Current trends include more cooperation across Europe and the implementation of more patient access schemes

Current trends include:

- The more formal cooperation of HTA across Europe

- Convergence of payer decision making

- National price agreements and more sophisticated schemes – e.g. portfolio agreements / national price negotiation

- Patient access schemes (e.g. rebate / risk share) are becoming standard practice

Group Discussion

Standardized rule of engagement

There is a need for clear rules and standards of evaluating / assessing personalized medicine, and creating transparency of standards

Best practice needed

- There is a need for policy makers to see tangible examples

- There are various elements of best practice occurring in different countries – need to bring these together. From industry POV need certainty. If want us to invest, we have to know what is the reason / what is the return. Also good to know when it isn’t going to work.

- NICE is now sharing innovative partnerships / contracting for others to follow

Value of long-term outcomes questioned

Payers are first and foremost trying to purchase health outcomes, but the length of time to see the outcome can dilute the impact and the fiscal argument

Industry should collaborate with payers sooner

Pharmaceutical companies should seek advice from payers much earlier to understand how to shape clinical trial design to add value and to assess which types of studies would add more value for the payer

Frameworks need to allow for innovation

- It would be beneficial to have a framework that allows for innovative approaches

- A solid framework or guidance at the EU level would be useful, which can be adapted at country level

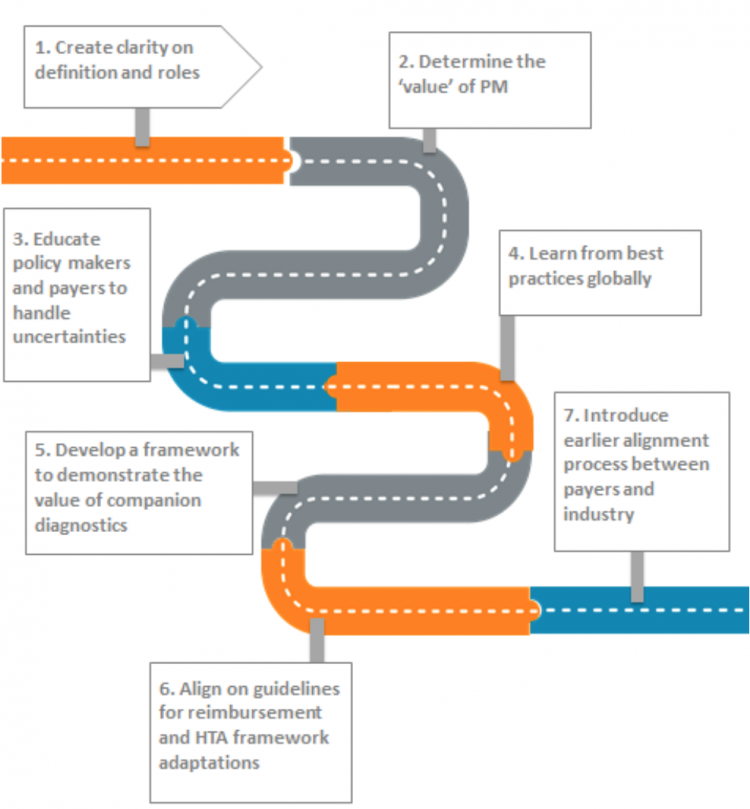

Roadmap

The below roadmap outlines six of the key considerations that arose as common themes throughout the discussion. All are relevant to all stakeholders who provided their perspective in this meeting, and this may provide a roadmap for improvements in current approaches to access to personalized medicine.