The early bird catches the worm

Leveraging early payer engagement to shape your asset’s optimal value proposition

Imagine the scenario. You spend years of scientific and commercial endeavour developing a genuine breakthrough therapy – a completely novel, first-of-its-kind treatment, offering hope to patients who had little before. The excitement builds towards submission, and finally, all the years of hard work and investment pay off with European-wide approval.

And then, nobody pays for it.

It’s a nightmare scenario, and exactly what happened to biotech company UniQure with its gene therapy Glybera for a rare genetic disorder called lipoprotein lipase (LPL) deficiency.

It serves as a stark reminder that Health Authority / regulatory agency approval does not mean reimbursement and market access. And that thinking about payer considerations is just as important in the early stages of drug development as the clinical considerations. A treatment might be ground-breaking in the clinical setting, but if patients can’t access it, what’s the point?

What payers want

While it is true that the payer landscape is complex and fragmented across geographies, the need to see value for money – products resulting in measurable, beneficial outcomes (to patients and payers as well as HCPs) at prices that are sustainable for healthcare systems – is a priority for all.

At present, much early drug development is driven solely by demonstrating clinical value, with few other market dynamics such as affordability or value for money taken into consideration. But understanding the payers’ definition of what constitutes value for your product is just as important – and this needs to be done early, so there’s enough time to design clinical programs accordingly.

But while companies are used to connecting with regulatory agencies at an early stage in the development lifecycle, relatively few take the plunge with payers or health technology assessment (HTA) agencies. This may be for various reasons, including a lack of knowledge about payer dialogue within organizations, a disconnect between R&D and Commercial within the company, the investment of time required or simply a degree of wariness of payers.

“Advanced preparation for market entry is really something the industry can do a lot better than it currently does,” says Dr. Dan Ollendorf, Director, Value Measurement & Global Health Initiatives at the Center for the Evaluation of Value and Risk in Health, Tufts University School of Medicine (USA). “Conversations really need to be had with payers before Phase 2 so that pivotal trials can be designed to help demonstrate the measures that matter most to reimbursement authorities, but often that just isn’t happening.”

So, what options are available to the pharmaceutical industry for early payer dialogue?

The what, why and when of early dialogue with payers

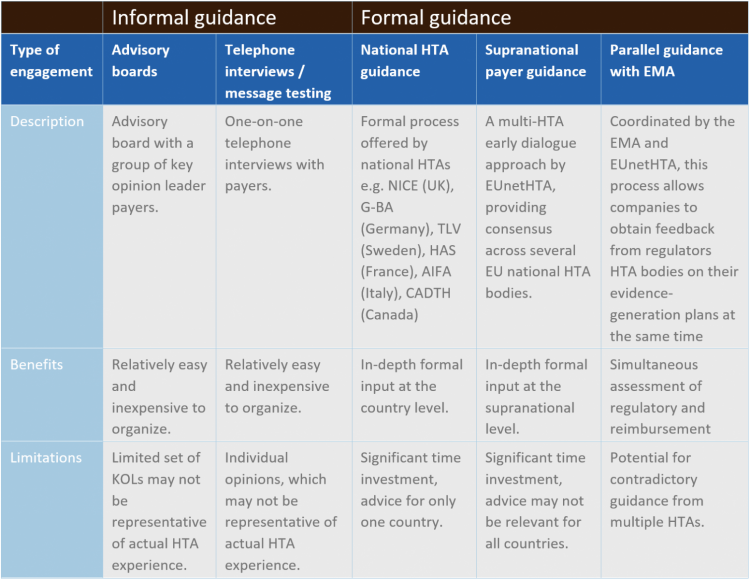

Early dialogue between pharma and payers can take various forms (see Table 1).

Table 1: Types of Payer Engagement

The most well established – and potentially the most valuable – format for early payer engagement is an official HTA advice service, either at the national or supranational level. Early HTA advice is often called scientific advice and is a process that enables manufacturers to collect non-binding feedback on clinical trial design, target populations, key outcome measures and other considerations, directly from payers at a pre-launch stage. It provides a fantastic opportunity for both stakeholders to align on clinical development programs and ensure appropriate access for patients.

“There are significant potential benefits for pharma companies,” explains Ollendorf. “Early scientific advice can provide crucial insights into HTA regulations, companies can benefit from specific clinical trial design feedback and they can even gain an early understanding of future HTA expectations.”

However, what it absolutely is not is any kind of guarantee of reimbursement. All HTA feedback is strictly non-binding.

It is also important to remember that early dialogue can be just as beneficial for HTAs. Assessing the value of new medications is often difficult, with innumerable variables involved. Once you start adding in unknowns – which is particularly the case with novel therapeutics and orphan drugs with no meaningful comparators available in the market – then it becomes particularly challenging. Early dialogue can help them to get a crucial early foothold in evaluating a therapy’s value.

When should it happen? In general, prior to the design and initiation of the pivotal Phase 2/3 clinical trial to ensure the trial can be designed in the optimal way to demonstrate value to payers.

The process can take up to 6-8 months to complete due to the need for internal alignment and back and forth with the HTA body. But it is possible to reach out too early. If there’s a lack of internal agreement on key decisions about, for example, major trial design decisions (e.g. the target population), then early dialogue with payers will not solve that for you.

National scientific advice: time-consuming but worth it

Early advice can take place at the national or supranational level. In Europe, at time of writing, the UK (NICE), Germany (G-BA), France (HAS), Italy (AIFA) and Sweden (TLV) offer some form of HTA advice service to the industry. Outside of Europe, CADTH in Canada & PBAC in Australia also offer early scientific advice and ICER in the US is considering such a program.

The benefit of gathering early advice via a national process is that manufacturers receive country-specific HTA recommendations, which may expedite the future process of seeking reimbursement at a local level.

The level of service and cost differs quite significantly between markets – for example, NICE in England offers the most customizable option but with relatively high fees (although reduced fees are possible for small and medium sized enterprises), whereas HAS in France has narrower options available, but advice is free.

All will require some form of “briefing book” – a country-specific central repository of all the crucial information and questions that the HTAs need to see. This is the most important step in the process, and time should be invested to ensure the briefing book is as comprehensive as possible. You will have the opportunity to ask questions to the HTA – these should not be too open-ended, but rather seeking clarity on well-considered elements of your program. This early work will shape the value of the subsequent discussions, so it is important to focus time, energy and resource at this stage.

A subsequent face-to-face meeting offers the opportunity to get answers to some of those crucial questions. Key decision makers from the pharmaceutical company should be present at the meeting, including senior clinical leads – it offers them a vital opportunity to gain consensus with the clinical experts from the HTA panel.

It’s a time-consuming process but considering the potential pay-off years down the line, well worth it.

Combined approaches

Alternatively, there is the option for combined simultaneous EU payer guidance. EUnetHTA has piloted a Multi-HTA early dialogue approach to provide a cooperative/consensus advice across several EU national HTA bodies, and NICE and CADTH have also recently launched their own parallel program. The aim of Multi-HTA dialogue is to reach a consensus advice for the manufacturer, but there are obviously challenges in obtaining consensus advice from all payers in different countries.

Finally, there is the option to combine payer guidance with EMA regulatory guidance. Scientific advice is coordinated by the EMA in association with national HTA bodies to bring all stakeholders together to provide the manufacturer with early scientific advice. Several HTA agencies can be invited to participate in the process, but again the advice will likely differ across markets, which can bring its own challenges for companies.

Improved value demonstration

What kind of feedback will you receive? Well, it could be potential challenges with trial design, for example issues with the comparator or trial endpoints. Perhaps you have selected surrogate endpoints that are not well established, or trial endpoints that don’t fit the value proposition. Such feedback would require further internal alignment and potentially new evidence generation or selection of new / additional endpoints.

There could also be potential issues with the proposed economic model, for example the absence of a plan for survival extrapolation, requiring further follow-up from your Phase 2 trials. Ideally, companies should have done enough early modeling to address these issues, but early HTA advice frequently brings up considerations that may not have been appreciated previously.

Whatever the advice received, the company will have an opportunity to fix any highlighted issues and ensure the major pivotal clinical trial is designed in the best possible way to help demonstrate value in a meaningful way to payers.

Conclusions

Pharma companies are comfortable with early regulatory agency engagement – now it’s time for the early development strategy to include payers as well. Early planning is imperative in value-focused healthcare and payers want more manufacturer involvement in evidence development to facilitate their decision-making. When early payer engagement succeeds, it provides manufacturers time to design clinical programs that are more likely to meet payer evaluation needs. This will result in therapies that are more cost effective and gain quicker market access, benefitting manufacturers, payers, and patients alike.

Executive Insight is a specialized healthcare consulting firm supporting biopharmaceutical companies to successfully prepare, launch and commercialize their products.

Please contact us at info@executiveinsight.ch for more information.

Special contribution

Daniel Ollendorf is Director of Value Measurement and Global Health Initiatives at the Center for the Evaluation of Value and Risk in Health (CEVR) at Tufts University Medical Center, as well as Assistant Professor of Medicine.